¶

This Lightpaper aims to explain the Zephyr platform as an AI-powered guessing space that is complemented by Wisdom of Crowds data analytics brought up by WEB 3 wind of change. The project aims to replicate transparent, whales-free, conventional trading and coin price forecasts covering all zeitgeisty markets under the crypto community's skin.

¶ What is Zephyr

Zephyr is a reimagined crypto predictions marketplace geared towards crypto enthusiasts. The project is a hybrid DeFi and GameFi model of prediction cyberspace that enables users to utilize inclusive market analytics and create profit on coins' price forecasts, IDO price shifts, NFTs, iGaming events, etc.

¶ Revolutionized Trading Ideology

Built from the ground up, the mechanism for placing forecasts on Zephyr eliminates the influence of whales and early birds (early token owners who have a profound effect on trading). Unlike classic trading platforms, Zephyr is free of these disadvantages. Following the decentralized values, all participants of a forecasting pool enjoy equitable standards.

Zephyr, a decentralized predictions marketplace, has a multiple-set grading system where users can opt-in to a particular pool and compete with other users of the same budget level. Big players compete with other major ones without intervening in a pool with minimum stakes. No shares or any other tools give the upper hand to one group and seize the opportunities from others.

¶ 5 Value-Driven Features of Zephyr

Zephyr reimagined long-established patterns of existing decentralized prediction markets (DPMs) and developed novel and gamified opportunities for turning endeavors into profit. The project also has 30% more success odds than classic trading and offers 5 genuine value-driven features.

¶ Disruptive Guessing Space

Zephyr is a decentralized guessing space that operates in the DeFi ecosystem with open-source staking contracts. The platform's operation is built on a trustless system, which allows users to interact with the protocol, relying on the smart contract's transparent work.

¶ Versatile Market Sentiment Analytics

Zephyr offers its adopters a revolutionized “collective judgment” approach to yield on any market, whether bearish or bullish. Lack of experience is an issue no more, while netizens have 30% more chances to succeed than on any crypto exchange.

The project enables its adopters to operate accurate market analytics to shore up their scoring before making any trading move. In contrast, crypto exchanges are also armed with such data but never share it with a basic user. Zephyr also holds arbitrage of top-rated KOLs' forecasts on crypto prices and shares results whether they touch the spot.

¶ Copy Guessing/Trading

Making the first steps in raising money on crypto may seem challenging, especially for people new to creating forecasts or synthetic trading. Zephyr offers a social trading feature to assist a whooping army of crypto newcomers in making informed decisions. Now, everyone can replicate Zephyr's top traders in real-time, enhancing daily trading performance. Every MVP will bolster their profit margins generating additional commission income from each deal.

¶ DeFi-related Staking and Liquidity-Providing Programs

Zephyr adopters can receive high-yield token rewards, also known as staking opportunities. The project offers a multi-stage staking program supercharged by a well-advised system to collect high-yield incentives and utilize the platform's exclusive features.

¶ AI-powered Price Analytics

Zephyr utilizes AI algorithms to provide users with price data on crypto coins. This premium feature has a key value for all traders who conduct DYOR, analyze hyped tweets of KOLs, or try to get complementary views of the crypto assets' financial behavior. It's a great point for beginners who hesitate to make the right move while creating a forecast.

¶ Market Research

Even the trying times of economic uncertainty deriving from the pandemic resulted in millions of people looking for alternative investment tools. Since March 2020, the global crypto market has skyrocketed by 900%. By extension of this point, crypto daily trading volume reached a peak of $500 billion in May 2021 and stabilized at an average of $120 billion per day.

The emergence of a decentralized Prediction Market (DPM) has also given netizens lucrative earning opportunities worldwide. It's easy to bet on the expected price of a crypto asset, IDO price surges, NFTs price, or the outcome of an online game tournament.

Regarded as a track that cannot be ignored, DPMs first appeared on the blog written by Vitalik Buterin: “Prediction Markets: Tales from the Election.” He expects more interest in prediction markets going forward, not just for elections but for conditional predictions, decision-making, and other applications as well.

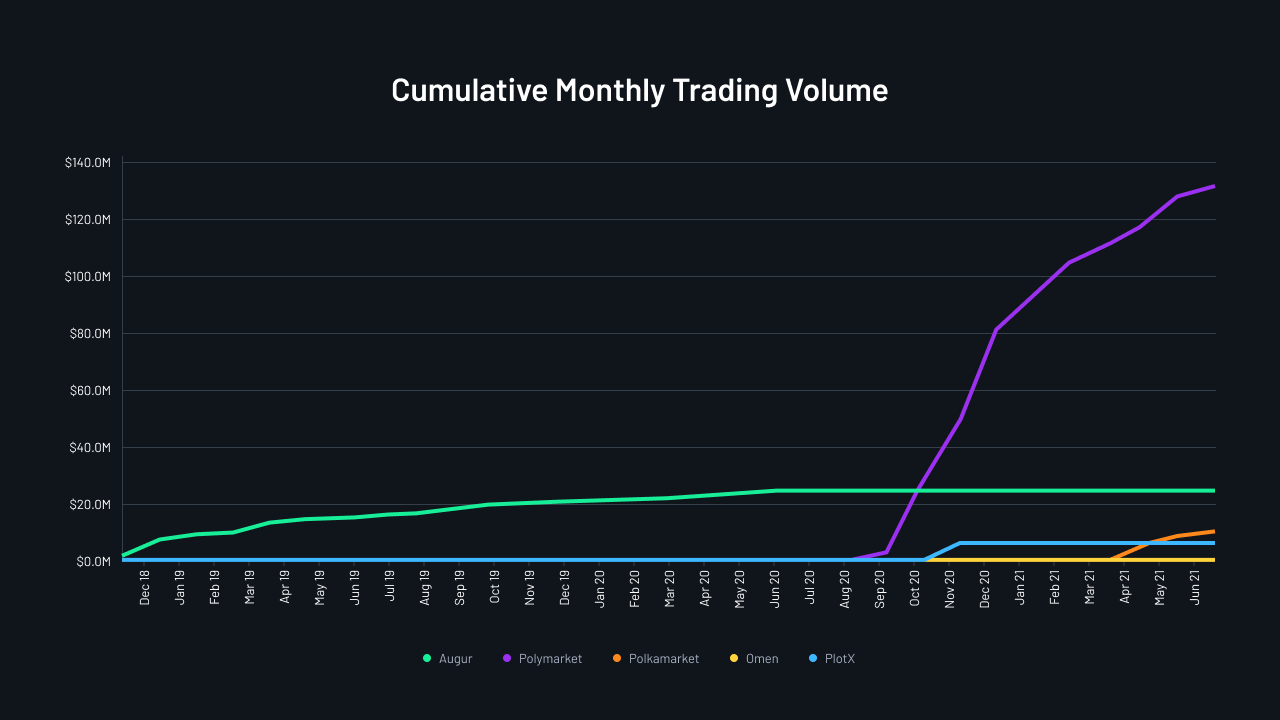

Meanwhile, DPMs have been breaking new ground since 2021. The cumulative monthly trading volume of the decentralized prediction market reached $130+ million in July 2021.

Nevertheless, DPM is still relatively niche, meaning it has great potential and a huge room for improvement for future projects. One of the main reasons is that conventional trading looks like contesting for beginners.

Trading complexity remains one of the main obstacles for users trying to make money on cryptocurrency. Being a trader in any market is demanding – only about 1% of all day traders can fix a profit.

Complex trading terminology, slippages, unexpected market pumps, whales, early token holders, and sophisticated tools of classic trading definitely play the wild with fresh crypto adopters. This resulted in searching for more intuitive but no less profitable instruments, including staked-based predictions.

¶ Challenges

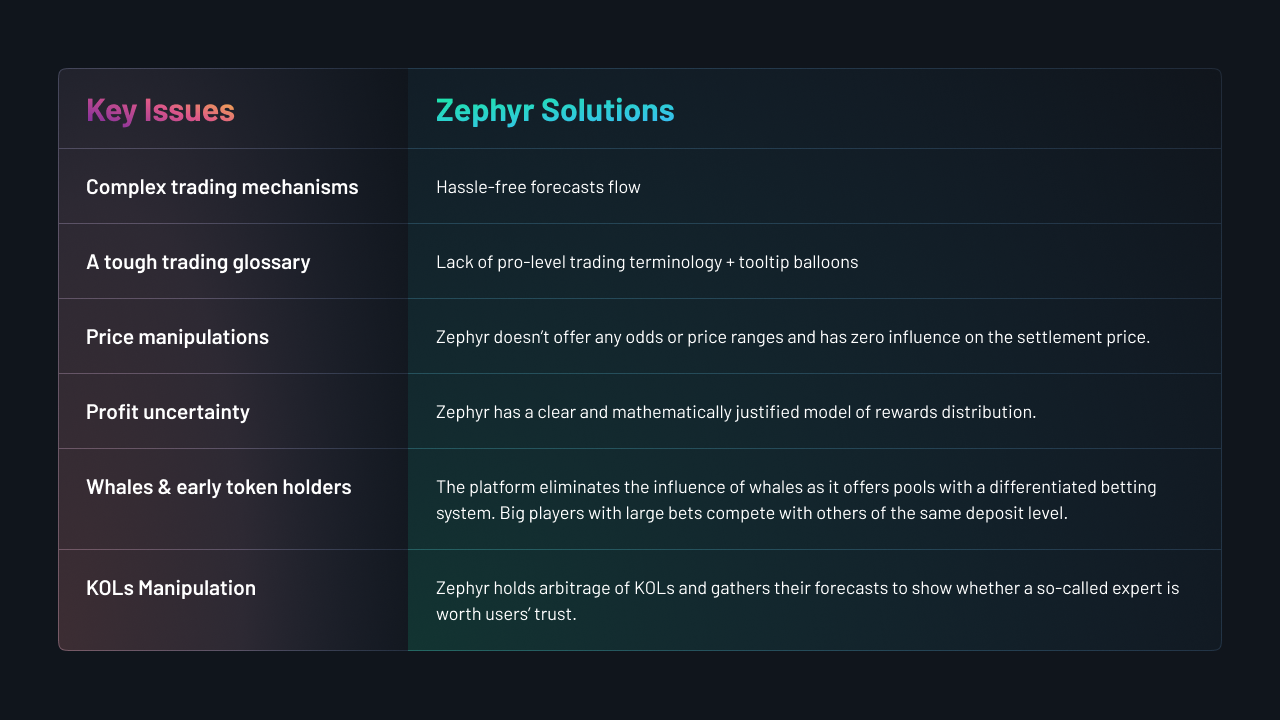

We conducted market research, and it became obvious that Zephyr covers both DPM and crypto exchange fields. The decentralized guess space platform creates an environment where users can fully experience all the benefits of synthetic trading (trading crypto assets without buying them).

That’s why we should shoot a glance at DPM projects’ lowlights and the crypto exchanges as pivotal places for trading. We are not here to tarnish the image of a particular DPM platform or a crypto exchange but to put some pain points on the ground.

Here are the long-standing problems the Zephyr project solves:

User-perspective issues: complex trading terminology, slippages, unexpected market pumps, whales, early token holders, and sophisticated tools of classic trading play the wild with fresh crypto adopters.

The Issue Explained:

Trading complexity remains one of the main obstacles for newly-minted users trying to make money on cryptocurrency. Plus, being a trader in any market is demanding. Nearly 40% day trade for only one month. Within three years, only 13% persist in day trade. After five years, only 7% stay. Finally, only about 1% of all day traders can fix a profit.

Current DPMs’ Downsides: profit uncertainty, binary predictions imbalance, outside influence, or high entry barrier.

The Issue Explained:

Decentralized predictions markets are in the early stage of development. Some take a binary approach to make predictions; others confuse the user's attention by offering too many unrelated markets.

Centralized Exchanges: Influence of whales, value-adds of early token owners, complex trading tools, centralized care, insider information, and KOLs manipulation.

The Issue Explained:

Centralized Crypto Exchanges are owned and run by a private business that controls 100% of all transactions. Traders of CCEs do not have access to the private keys of their exchange account’s wallets. This puts all of the user’s trust in the hands of the exchange operators. The worst thing is that CCEs can easily conduct insider trading, demonstrate fake trading volume, and run price manipulations.

Decentralized Exchanges: Unusually high gas fees, price manipulations, front-running + MEVs.

The Issue Explained:

There is always a chance that DEXs can manipulate prices at any convenient moment. It is not uncommon for traders to witness higher prices on decentralized exchanges than on centralized ones. The worst of it is that all orders are public on a DEX, and some mechanisms can influence a trader’s order while its validators can gain an unfair advantage in being able to front-run.

¶ Solutions

Modern crypto owners aiming at raising money on cryptocurrency pursue two main goals:

- Making money by speculating with crypto assets

- Using cryptocurrencies as a risk diversification tool for HODLing or long-term savings

In the first and second cases, operations with cryptocurrencies come down to the opportunity to earn on trading and storage.

Zephyr is focused on the first point, namely, earning on cryptocurrencies through trading. For this purpose, the project provides users with a set of high-yielding features and additional benefits within the platform.

¶ Quick Market Figures

The sky's the limit for DPM projects regarding target audience (TA) capture. In keeping with this approach, Zephyr is centered on every trader, crypto owner, and all crypto-curious netizens having incentives to step into crypto and earn with it.

The would-be TA for the Zephyr project includes but is not limited to the following:

● Crypto Owners - 300+ million users

● Active Crypto Traders - 51+ million

● Gamers Who Own & Use Crypto - 41.9 million

● NFT Traders - 360K+

The project TA (target audience) belongs under each of the segments above, and we expect the total audience value for DPMs to reach 25-30 million by the end of 2022.

¶ Token Details

Zephyr runs a dual-token model and divides the project's ecosystem into two tokens for better usability. The dual-token economy of Zephyr is used to create a better incentive structure, access new features, boosting upgrades and functionalities for the end users. Both tokens - USDZ and $ZEPH are offered to enable users to create forecasts and unveil the project's full potential.

¶ References & Other Links

Find Out More:

Token sale schedule: https://zephyr.digital/landing/token/

¶ Stay In Touch

- Telegram: https://t.me/ZephyrSpace

- Twitter: https://twitter.com/Zephyr_Platform

- Discord: https://discord.gg/5qawn395WR

- Medium: https://medium.com/@zephyr_space